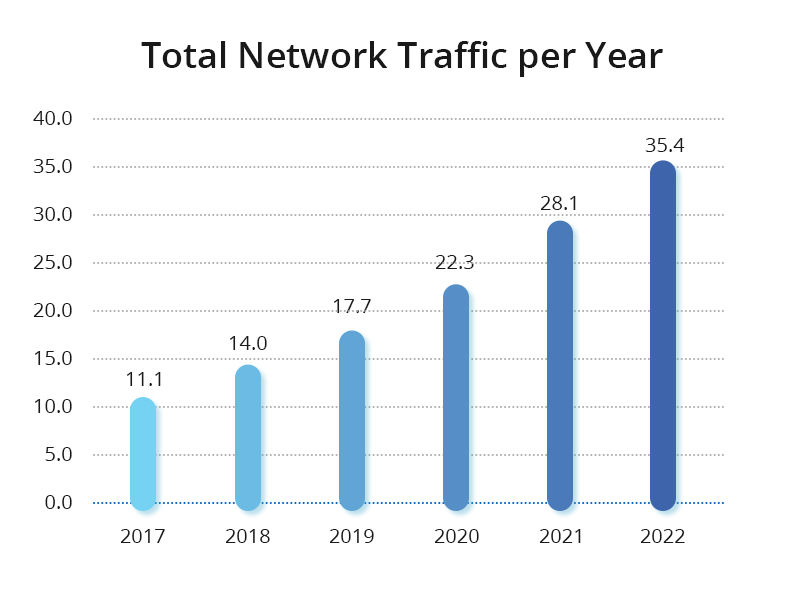

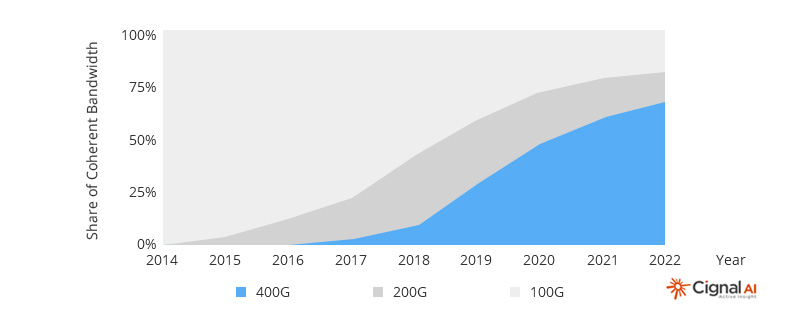

Higher bandwidth requirements are enhancing the need for 400G optical modules in the large data center interconnections. And a series of tests is significant to ensure the high quality of the 400G transceivers. This article will introduce the 400G transceiver test from three aspects: challenges, key items, and opportunities.

Challenges of 400G Transceiver Test

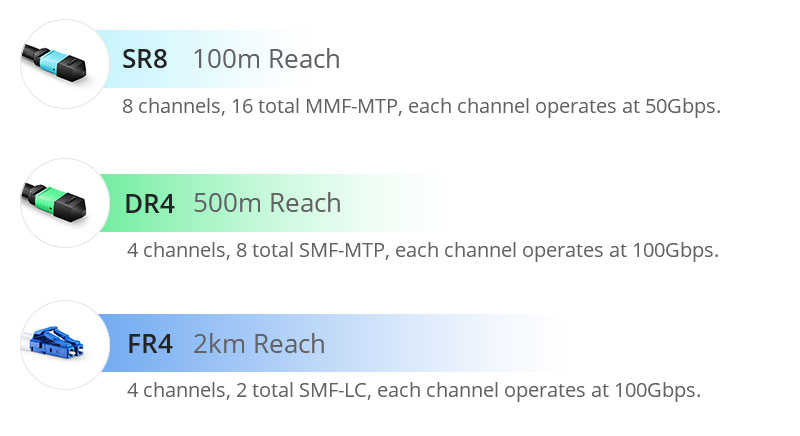

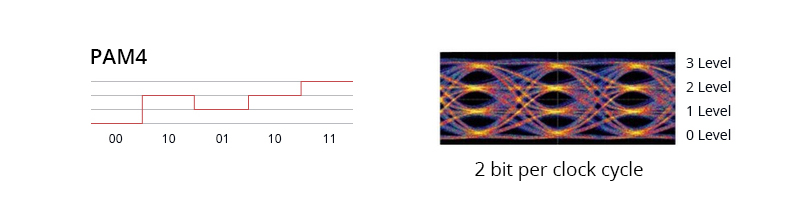

The electrical interfaces of 400G transceivers use either 16× 28Gb/s with NRZ (non-return to zero) modulation or the newer 4 or 8× 56Gb/s with PAM4 (4-level pulse amplitude) modulation. Higher speeds and the utilization of PAM4 do bring great improvements but also result in high complexity at the physical layer, causing signal transmission errors easily and bringing challenges for optical module vendors.

High Complexity at the Physical Layer

On the physical appearance layer, the high-speed interfaces of 400G optical modules include more electrical input/output interfaces, optical input/output interfaces, and other power and low-speed management interfaces. And all the performance of these interfaces should be made to a complaint of 400G standards. As the size of 400G transceivers is similar to the existing 100G transceivers, the integration of those interfaces needs more sophisticated manufacturing technology.

Signal Transmission Errors

The higher lane speed in 400G electrical interfaces means more noise (also called signal-to-noise ratio) in signal transmission, causing an increased bit error rate (BER), which in turn affects the signal quality. Therefore, corresponding performance tests should be taken to ensure the quality of 400G modules.

Development & Manufacturing Test Costs

The complex 400G transceiver test also brings new challenges for the optical module vendors. To ensure the transceiver quality for users, vendors have to attach great importance to the transceiver test equipment and R&D technical. They should ensure that the new products can support 400G upgrade while dampening associated development and manufacturing test costs that may hamper competitive pricing models.

Key Items in 400G Transceiver Test

For transceiver vendors, product quality testing is fundamental to building reliable connections with customers. Let’s have a look at the key items in the 400G transceiver test. For more detailed information, please visit the 400G QSFP-DD Transceivers Test Program.

ER Performance and Optical Power Level Tests

ER (extinction ratio), the optical power logarithms ratio when the laser outputs the high level and low level after electric signals are modulated to optical signals, is an important and the most difficult indicator to measure the performance of 400G optical transceivers. The ER test can show whether a laser works at the best bias point and within the optimal modulation efficiency range. OMA (outer optical modulation amplitude) can measure the power differences when the transceiver laser turns on and off, testing 400G transceivers’ performance in another aspect. Both the ER and the average power can be measured by mainstream optical oscilloscopes.

Optical Spectrum Test

The optical spectrum test is mainly divided into three parts: center wavelength, side mode suppression ratio (SMSR), and spectrum width of the 400G transceivers. All of these three parameters are essential for keeping a high-quality transmission and performance of the modules. The larger the value of the side mode suppression ratio, the better the performance of the laser of the module. Watch the following video to see how FS tests the optical spectrum for 400G QSFP-DD transceivers.https://www.youtube.com/embed/xMwbi85Hlig?rel=0&showinfo=0&enablejsapi=1&origin=https%3A%2F%2Fcommunity.fs.com

Forwarding Performance Tests

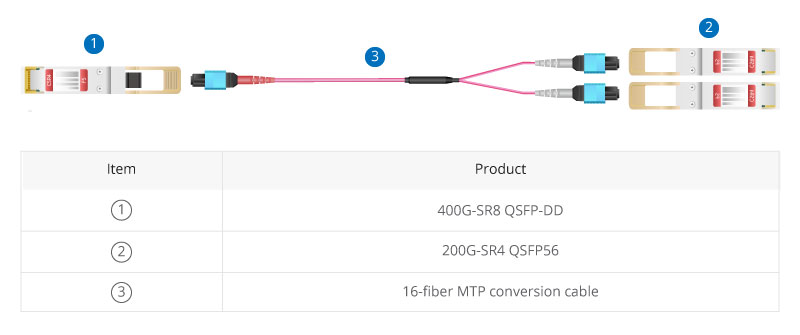

400G transceiver has a more complicated integration compared with the existing QSFP28 and QSFP+ modules, which puts higher requirements for the test of its forwarding performance. RFC 2544 defines the following baseline performance test indicator for networks and devices: throughput, delay, and packet loss rate. In this test procedure, the electrical and optical interfaces will be tested and make sure the signal quality they transmitted and received will not get distortion.

Eye Diagram Test

Different from the single eye diagram of NRZ modulation in 100G optical transceivers, the PAM4 eye diagram has three eyes. And PAM4 doubles the bit bearing efficiency compared with NRZ, but it still has noise, linearity, and sensitivity problems. IEEE proposes using PRBS13Q to test the PAM4 optical eye diagram. The main test indicators are eye height and width. By checking the eye height and width in the test result, users can tell if the signal linearity quality of the 400G transceiver is good or not.

The following video shows how FS tests 400G QSFP-DD-SR8 transceivers’ eye pattern with Anritsu MP2110A All-in-One BERT and Sampling Oscilloscope to ensure the QSFP-DD transceivers’ signal quality.https://www.youtube.com/embed/DlfMLDy6VmY?rel=0&showinfo=0&enablejsapi=1&origin=https%3A%2F%2Fcommunity.fs.com

Jitter Test

The jitter test is mainly designed for the output jitter of transmitters and jitter tolerance of receivers. The jitter includes random jitter and deterministic jitter. Because deterministic jitter is predictable when compared to random jitter, you can design your transmitter and receiver to eliminate it. In a real test environment, the jitter test is operated together with the eye diagram test to check the 400G transmitter and receiver performance.

Bit Error Rate Test in Real Working Condition

In this testing procedure, 400G optical transceivers will be plugged into the 400G switches to test their working performance, BER, and error tolerance ability in a real environment. As mentioned above, the higher BER in 400G optical transceiver lanes leads to transmission problems in most 400G links. Therefore, FEC (forward error correction) technology is applied to improve signal transmission quality. FEC provides a way to send and receive data in extremely noisy signaling environments, making error-free data transmissions in 400G link as possible. How FS tests the BER of 400G QSFP-DD modules is displayed in the following video to ensure the stability and reliability of the transmission.https://www.youtube.com/embed/KJ7eWECtZ54?rel=0&showinfo=0&enablejsapi=1&origin=https%3A%2F%2Fcommunity.fs.com

Temperature Test

Each 400G transceiver module comes with a vendor-defined operating temperature range. If the temperature exceeds or beyond the normal temperature range, then the modules will fail to perform well or even won’t operate normally, and even lead to delays or network breakdowns. So the temperature test is also essential for the transmission performance of transceivers. This is to guarantee the reliability of these high-speed 400G transceivers used within the high-speed communication network and data centers. The video below shows how FS tests its 400G QSFP-DD modules at different temperatures.https://www.youtube.com/embed/CgwfapEcU2o?rel=0&showinfo=0&enablejsapi=1&origin=https%3A%2F%2Fcommunity.fs.com

Opportunities in 400G Transceiver Test

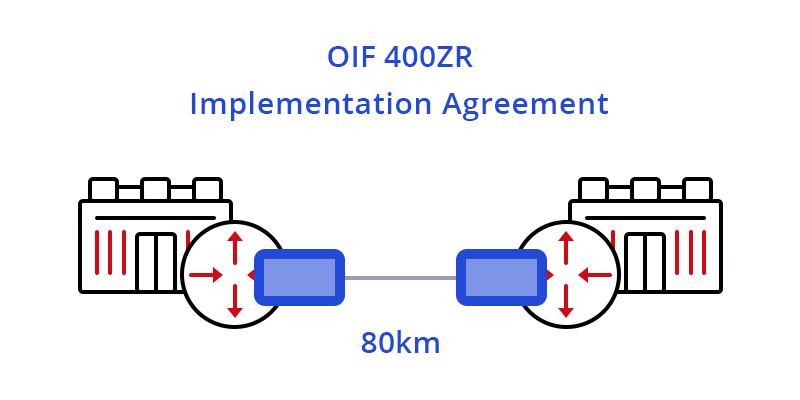

Driven by 5G, artificial intelligence (AI), virtual reality (VR), Internet of Things (IoT), and autonomous vehicles, though multiple technical transceiver test issues are needed to be resolved, the booming trend of the 400G Ethernet market cannot stop. Lots of manufacturers and test solution providers have promoted their own 400G product solutions to the market. Under this situation, for some smaller optical module vendors, the 400G transceiver test is one of the key points they should consider, because how to improve the quality of the 400G products and supply speed will determine how much profit they get from the 400G market. Know more about What’s the Current and Future Trend of 400G Ethernet? to prepare for the coming fast-speed era.

Original Source: 400G Transceiver Test – How Does It Ensure the Quality of Optical Modules?