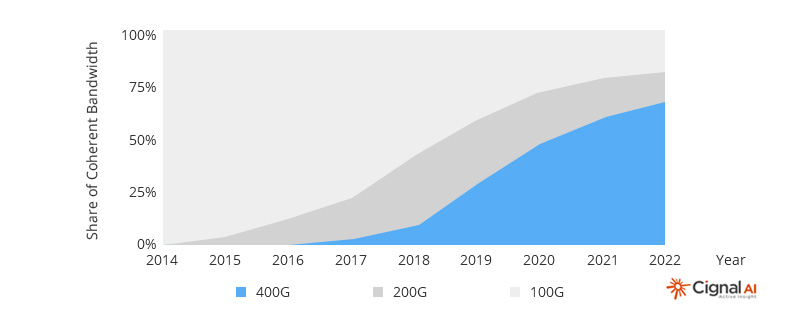

New data-intensive applications have led to a dramatic increase in network traffic, raising the demand for higher processing speeds, lower latency, and greater storage capacity. These require higher network bandwidth, up to 400G or higher. Therefore, the 400G market is currently growing rapidly. Many organizations join the ranks of 400G equipment vendors early, and are already reaping the benefits. This article will take you through 400G Ethernet market trend and some global 400G equipment vendors.

The 400G Era

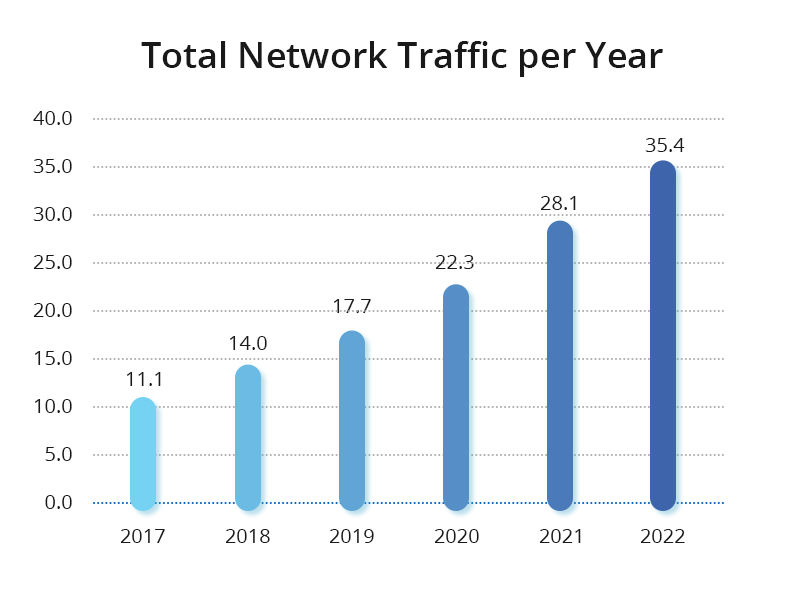

The emergence of new services, such as 4K VR, Internet of Things (IoT), and cloud computing, raises connected devices and internet users. According to an IEEE report, they forecast that “device connections will grow from 18 billion in 2017 to 28.5 billion devices by 2022.” And the number of internet users will soar “from 3.4 billion in 2017 to 4.8 billion in 2022.” Hence, network traffic is exploding. Indeed, the average annual growth rate of network traffic remains at a high level of 26%.

Facing the rapid growth of network traffic, 100GE/200GE ports are unable to meet the demand for network connectivity from a large number of customers. Many organizations and enterprises, especially hyperscale data centers and cloud operators, are aggressively adopting next-generation 400G network infrastructure to help address workloads. 400G provides the ideal solution for operators to meet high-capacity network requirements, reduce operational costs, and achieve sustainability goals. Due to the good development prospects of 400G market, many IT infrastructure providers are scrambling to layout and join the 400G market competition, launching a variety of 400G products. Dell’Oro group indicates “the ecosystem of 400G technologies, from silicon to optics, is ramping.” Starting in 2021, large-scale deployments will contribute meaningful market. They forecast that 400G shipments will exceed 15 million ports by 2023, and 400G will be widely deployed in all of the largest core networks in the world. In addition, according to GLOBE NEWSWIRE, the global 400G transceiver market is expected to be at $22.6 billion in 2023. 400G Ethernet is about to be deployed at scale, leading to the arrival of the 400G era.

Companies Offering 400G Networking Equipment

Many top companies seized the good opportunity of the fast-growing 400G market, and launched various 400G equipment. Many well-known IT infrastructure providers, which laid out 400G products early on, have become the key players in the 400G market after years of development, such as Cisco, Arista, Juniper, etc.

Cisco

Cisco foresaw the need for the Internet and its infrastructure at a very early stage, and as a result, has put a stake in the ground that no other company has been able to eclipse. Over the years, Cisco has become a top provider of software and solutions and a dominant player in the highly competitive 25/50/100Gb space. Cisco entered the 400G space with its latest networking hardware and optics as announced on October 31, 2018. Its Nexus switches are Cisco’s most important 400G product. Cisco primarily expects to help customers migrate to 400G Ethernet with solutions including Cisco’s ACI (Application Centric Infrastructure), streamlining operations, Cisco Nexus data networking switches, and Cisco Network Assurance Engine (NAE), amongst others. Cisco has seized the market opportunity and is continuing to grow its sales with its 400G products. Cisco reported second-quarter revenue of $12.7 billion, up 6% year over year, demonstrating the good prospects of 400G Ethernet market.

Arista Networks

Arista Networks, founded in 2008, provides software-driven cloud networking solutions for large data center storage and computing environments. Arista is smaller than rival Cisco, but it has made significant gains in market share and product development during the last several years. Arista announced on October 23, 2018, the release of 400G platforms and optics, presenting its entry into the 400G Ethernet market. Nowadays, Arista focuses on its comprehensive 400G platforms that include various series switches and 400G optical modules for large-scale cloud, leaf and spine, routing transformation, and hyperscale IO intensive applications. The launch of Arista’s diverse 400G switches has also resulted in significant sales and market share growth. According to IDC, Arista networks saw a 27.7 percent full year switch ethernet switch revenue rise in 2021. Arista has put legitimate market share pressure on leader Cisco in the tech sector during the past five years.

Juniper Networks

Juniper is a leading provider of networking products. With the arrival of the 400G era, Juniper offers comprehensive 400G routing and switching platforms: packet transport routers, universal routing platforms, universal metro routers, and switches. Recently, it also introduced 400G coherent pluggable optics to further address 400G data communication needs. Juniper believes that 400G will become the new data rate currency for future builds and is fully prepared for the 400G market competition. And now, Juniper has become the key player in the 400G market.

Huawei Technologies

Huawei, a massive Chinese tech company, is gaining momentum in its data center networking business. Huawei is already in the “challenger” category to the above-mentioned industry leaders—getting closer to the line of “leader” area. On OFC 2018, Huawei officially released its 400G optical network solution for commercial use, joining the ranks of 400G product vendors. Hence, it achieves obvious economic growth. Huawei accounted for 28.7% of the global communication equipment market last year, an increase of 7% year on year. As Huawei’s 400G platforms continue to roll out, related sales are expected to rise further. The broad Chinese market will also further strengthen Huawei’s leading position in the global 400G space.

FS

Founded in 2009, FS is a global high-tech company providing high-speed communication network solutions and services to several industries. Through continuous technology upgrades, professional end-to-end supply chain, and brand partnership with top vendors, FS services customers across 200 countries – with the industry’s most comprehensive and innovative solution portfolio. FS is one of the earliest 400G vendors in the world, with a diverse portfolio of 400G products, including 400G switches, optical transceivers, cables, etc. FS thinks 400G Ethernet is an inevitable trend in the current networking market, and has seized this good opportunity to gain a large number of loyal customers in the 400G market. In the future, FS will continue to provide customers with high-quality and reliable 400G products for the migration to 400G Ethernet.

Getting Started with 400G Ethernet

400G is the next generation of cloud infrastructure, driving next-generation data center networks. Many organizations and enterprises are planning to migrate to 400G. The companies mentioned above have provided 400G solutions for several years, making them a good choice for enterprises. There are also lots of other organizations trying to enter the ranks of 400G manufacturers and vendors, driving the growing prosperity of the 400G market. Remember to take into account your business needs and then choose the right 400G product manufacturer and vendor for your investment or purchase.